3 Top Tips For First Home Buyers

Buying your first home in NZ is stressful enough but yet very very rewarding as it is part of the Kiwi dream to own a home! Here are 5 top tips for first home buyers in New Zealand.

You might be thinking you’ll never be able to buy a home because the deposit keeps rising every year and you’re just chasing its tail year on year. However, you can still purchase a property with a 10% deposit, not the ideal 20% deposit, as banks do have a limit of how much funding they can lend to first home buyers with less than a 20% deposit!

I’ve helped many clients who were on the boat like you, thinking that you’re competing with investors who have a lot more equity to play the field and feel like is an unfair advantage.

However, with the NZ Labour government recently changing the rules it’s now favoured a lot more for first home buyers. These top tips for first home buyers will hopefully help you navigate the journey of owning your first home.

So, what were the rules that changed on 23rd March 2021?

The key features that change for first home buyers were the First Home Grant, where they increase two criteria, these being the income & property price cap.

If you didn’t know what the First Home Grant is, I’ve written a whole article here and also ways to increase your deposit fast!

I’ll make a quick recap here, if you meet the full criteria on the First Home Grant, then you’ll be eligible to receive a maximum of up to $5,000 for existing properties and up to a maximum of $10,000 for new properties.

The longer you stay in Kiwisaver, which is more than 5 years then that is the maximum you’ll receive, the minimum is 3 years with Kiwisaver and will need to be contributing to Kiwisaver.

So here are the key changes:

Income caps increased: If you earn up to $95k in the last 12 months, remember it’s the last 12 months not per year. You can check how much you earnt through the IRD website. If more than 2 borrowers the cap is now increased to $150k, again in the last 12 months. These were increased from $85k & $130k respectively.

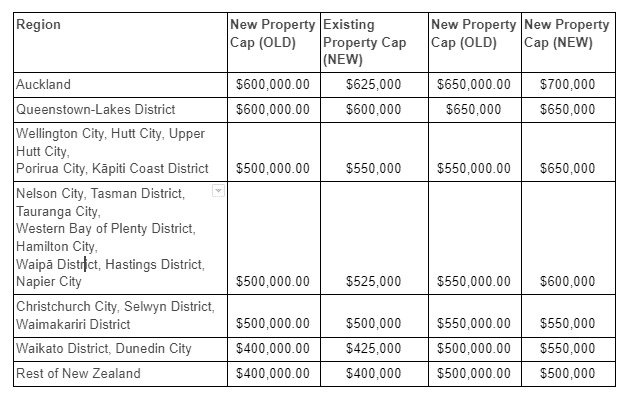

Property price caps increased: This is better illustrated below in a table format

These changes will come into effect from April the 1st of 2021, this will then allow more first home buyers to access the grant around the region.

I do think it is still quite hard for people to find a home within those price caps around Auckland and Queenstown, apart from purchasing a Kiwibuild property.

So the first thing to do is if you want to find more about these price caps that you’d be eligible is to talk to your mortgage adviser or broker. Otherwise, you can seek more information from the government’s website Kainga Ora.

If you want to know more about how a pre-approval works and also what other professionals you want in your team, you can click the link here.

Building up that deposit as fast as possible

The first top tips for first home buyers are building up a deposit as fast as you can, there are a few ways you can achieve this. Because the hardest bit to homeownership is getting the 10% or 20% deposit ready.

So, how much deposit do you really need. With the first home grant and some of the first home loans that some lenders offer you can purchase a home with as little as a 5% deposit. However, this is extremely difficult because the servicing is quite hard to pass, meaning that your income needs to be extremely high to be able to get approval with a 5% deposit for your first home.

So here are some of the ways to build a quick deposit, think of this as a bonus top tips for first home buyers and this is really relevant for New Zealanders.

- Increase your Kiwisaver contributions

- Understand your expenses and find ways to minimise them so that you can increase your savings rate

- Saving all your pay and bonus increases, treat like that you’re still earning the same amount of money after the pay increase. Oh and by the way, congratulations!

- Reduce or remove the temptation of credit, i.e. the ease of putting things on short term debt, these being Afterpay, credit cards and personal loans. Only buy things that you can afford with cash!

- Access the first home grant as mentioned above

- Plan ahead with what you want to buy and look at sacrificing what you want to purchase. It’s your first home and doesn’t need to be a palace!

- The bank of mum and dad i.e. by way of gifting, guarantee/guarantor and loan from mum and dad. It is best that you either seek professional legal advice on both parties so that they know what each party is getting themselves into.

Look at buying a new build rather than an existing home

The Government and local bodies are really pushing for people to purchase new homes rather than existing properties.

Even though the ideal land is the quarter-acre section, chances are these are very limited especially in the CBD area, unless you look further out of the city fringes. Hence why the government want people to buy a property with smaller lands as they can maximise the land for population growth.

Even though you may be looking for the bigger land, the bright side is that the maintenance of a new home will be minimal and less worry about mowing down the lawns!

Seek professional advice

Many people like myself don’t get taught this in schools or even by our parents. So there are the biggest top tips for first home buyers. Because we don’t get taught the ins and outs of the process of buying a home, we have to rely on professional advice. You can do all the research you want, but at the end of the day you need to put what you read into practice and you want to ensure you get it right!

I’ve seen so many people who could have saved thousands of dollars if they got the right advice from professionals, the banks can get you the approval, but the advice you need is what separates a stressfree property purchase from a very not fun process and stressful situation.

There are a lot of moving parts when purchasing a home, such as at what stage do I need finance, where does Kiwisaver withdrawal come in, how much deposit do I really need to pay and what is the best mortgage structure?

These are just some of the most common questions I get from first home buyers that seek out their first home.

Summary - Top tips for first home buyers

There you have it, those are my 3 top tips to buying your first home. I can go into a lot more detail, but as you’re aware if you’ve landed on my page. You’ve already done a huge amount of research and just want somewhere that has concise information to proceed. We live in a world of overwhelming information and it’s enough to differentiate what is right and what is wrong.

The key with anything is really to sit down with yourself or with your partner and write down the things you want. By doing so, it cements an idea in your conscious that this is a goal or a plan you want to achieve.

If you don’t plan, you plan to fail which is a great quote I’m sure many of you have heard.

If you want to get mortgage advice, you can book a time with me below or flick me an email at will@simplyfinance.co.nz.

One last tip is just to enjoy the ride and have fun!! I know it can be stressful buying your first home, I’ve been there and making it fun just takes the house hunting to a whole new level!